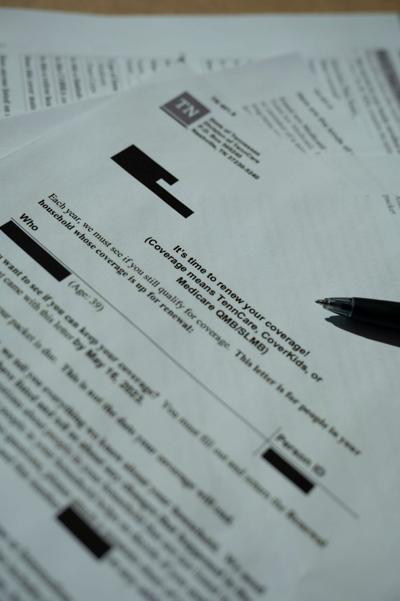

More than 147,000 Tennesseans have lost TennCare coverage since April, as the state insurance provider nears the halfway point of a year-long unwinding process.

In the first four months of data released, the majority (76.2 percent) who lost coverage did so because of bookkeeping issues — the enrollee didn’t return the necessary information to TennCare in time or didn’t respond at all, or their renewal paperwork was lost along the way back to TennCare. (According to TennCare, 46 percent of people renew over the phone, compared to 27 percent renewing by both mail and online.) One woman from Southeast Tennessee is on the verge of becoming one of those people.

Her mother and conservator Joan, who asked that the Post use only her first name, typically renews TennCare coverage for three family members per year: her two adult daughters with disabilities and her brother. She hasn’t had to do so since 2020, as the public health emergency put the yearly redeterminations on pause, but she told the Post she never had an issue renewing coverage prior to the pandemic.

“We’ve never had this much trouble before,” Joan said. “We’ve done reauthorizations before and it’s never been like this.”

This year, as TennCare looks to shrink its 1.7 million enrollment down to pre-pandemic levels of closer to 1.4 million, she hit a snag with one daughter’s coverage.

Her daughter, who has been on TennCare since 2017, is also part of TennCare’s Employment and Community First CHOICES program for people with disabilities. The program provides aides to help her take her medication effectively, learn independent living and job skills and provide rides to the grocery store and other community activities.

Joan’s daughter lives separately from her family, but all of her mail is supposed to go to her parents. The first TennCare renewal issue arose when mail went to her apartment, though Joan was able to intercept the letter.

When her daughter’s coverage came up for renewal in May, Joan called to speak with a representative and answered some renewal questions over the phone. She also mailed in the full packet on May 31, including the application, housing and utilities information, pay stubs and bank statements. On June 26, Joan received a letter from TennCare stating that she had not sent the required information. So she faxed the documents again and kept a copy of the confirmation from the fax machine. On July 17, her daughter’s services coordinator with ECF CHOICES noticed that her coverage was set to be terminated on Aug. 3.

Joan began to get nervous, worried that her daughter losing support from CHOICES would mean she could no longer live independently.

The reasoning was murky — when she and the services coordinator called TennCare’s phone line on July 20, one person said the reasoning was because Joan had not sent in the financial information requested and another said TennCare did have the necessary documents, but they were missing information about a bank account that had been a part of certification in previous years. The family had closed the account in 2021 because the daughter had lost her checkbook.

Thinking she’d found the issue, Joan filed an appeal that day over the phone. On Aug. 7, she got a letter from TennCare signifying changes in income information, which she suspected was regarding the closed checking account. The letter pointed her to the TennCare Connect online portal to confirm the change, but the information wasn’t there. So she called, again, and found out that TennCare was using her daughter’s year-to-date income as her monthly income, which rendered her ineligible due to income limits.

“If I hadn’t caught it, they would have sent me a letter and said, ‘you’re terminated because you make too much money,’ and I would have had to start over with another appeal process,” Joan said. “If I didn’t have the time and the tenacity to go in and call and call and call and call, I would have never found that out. I really feel for the people who do not have the wherewithal to do this. It just makes me very sad.”

Even before the large-scale unwinding, paperwork stood in the way of TennCare coverage for eligible Tennesseans. A 2020 federal lawsuit brought by TennCare families alleged that renewal practices have been a challenge for years. The suit was recently amended to include experiences from 2023’s unwinding process. A 2019 investigation by The Tennessean found that 220,000 kids lost TennCare coverage due to clerical errors from 2016 through 2018. It wasn’t until 2019 that TennCare launched an online portal to assist with redeterminations.

A trial is set for Nov. 14 to determine if TennCare’s processes are fair and comply with Centers for Medicare and Medicaid Services regulations.

Local nonprofits assist, advocate for TennCare users

Joan turned to the Tennessee Justice Center, a statewide health care-focused advocacy organization, which assured her that her daughter was, in fact, eligible.

“The whole time it’s been very very stressful. Even though, on paper, we’re in limbo, we feel very comfortable that the information [TennCare has] shows that she’s eligible according to their rules,” she said. “I’m not as panicked as I have been throughout the process when they kept saying, ‘you didn’t give us this information, so you’re off.’”

Social workers at TJC mitigate a range of issues — some people don’t receive the paperwork, some people don’t understand it, and some people don’t think it’s important and throw it away — said Michele Johnson, executive director of the organization.

“When something is not working for three-quarters of the people it seems like going back to the drawing board and figuring out how they can create a better process is vital and urgent,” Johnson said. “Many times people never received a notice. They don’t know where the notice went. They hadn’t moved. They go to the pharmacy to get medicine and they can’t get the medicine, or they go to take their child to therapies and they can’t get the therapies.”

Family and Children’s Services, a statewide nonprofit based in Nashville, offers in-person help to those navigating TennCare renewal, especially for those with low technological or English literacy — the TennCare online portal is only offered in English and Spanish. FCS can also help link people to marketplace insurance at healthcare.gov if they no longer qualify for TennCare. Open enrollment begins Nov. 1 and lasts until Jan. 15, but those who lose TennCare coverage qualify for special enrollment until July 31.

“Those are the populations with the highest need — are people with literacy barriers, whether that's English language or just reading in general, or any sort of mental and physical disabilities,” said Emilie Fauchet, assistant director for health care access services at Family and Children’s Services. “I also think that even for the average person, it can be a difficult process to navigate.”

Joan’s daughter still has coverage while TennCare is confirming her eligibility, and the family recently received another letter saying she’s up for redetermination again in November. The process has been confusing and time-consuming, Joan said.

“That’s the thing that makes me cry and keeps me up at night,” she said. “I am college-educated. Yes, I’m getting older, but I have some skills. I have tenacity. I’m not without resources, emotional resources. I think of the other people that I know, that I’ve worked with through my volunteer activities and I think, ‘how in the world could they negotiate this?’ I’m retired. Most of these people are working. You don’t have time to sit on the phone for three hours every time you have to do one little thing.”

TennCare told the Post it did not collect data on the race of the applicants losing coverage.

"We are using multiple forms of communication to try and reach members including text, email, and paper notifications, so it’s important that people open and respond to communication from TennCare," Amy Lawrence, TennCare spokesperson, said earlier this month.

"It’s also important to note what we are seeing in Tennessee is similar to the experiences of other Medicaid agencies," Lawrence added. "As has been true since the start of the unwinding, we remain one of a minority of states that do not require a mitigation plan from CMS, which is a reflection of all the work we have done to be prepared for renewals.”